Importance Of Technical Analysis Of Stock Trends

Specialized examination is the assessment of the value development of the stocks on the lookout.

One day the cost of the offer is up, and on a few days ago, maybe the offer value descends, much the same as your life that is loaded with high points and low points. In any case, on the off chance that you see the stock value development, patterns a lot arise, considering the diagrams examples and patterns of stock development is called specialized investigation.

Correctly, specialized examination inspects how request and supply of stocks influence the adjustments in cost and volume of offers for a brief timeframe.

The specialized investigation is based on some basic presumptions to foresee the style in which the stock cost is moving. Further, the expert examiners acknowledge three general suspicions for the control. That are as per the following: – Basic Assumptions of Technical Analysis

Value Discounts Everything

To foresee the future stock cost with past information, speculators utilize two methodologies, in particular essential investigation, and specialized examination. Essential investigation examines the organization's budget reports alongside miniature and full scale financial information just as the danger factor of the stock on the current market cost in a given period. Then again, the specialized investigation thinks about just the value development.

Specialized experts expect all speculators are now mindful of everything about a stock as whatever influences the cost is considered in advance by consolidating basic investigation.

Subsequently, the lone thing concentrated under specialized examination is the value development that gets influenced by the powers of interest and supply spoke to on graphs.

Costs Follow a Given Trend

This suspicion shows the cost follows a previous pattern instead of moving unevenly. Each stock outline portrays its remarkable pattern and the stock value moves inside the pattern. It shows which stock will drift in the example. At the point when a pattern gets set up the stock cost is accepted of moving in a specific example until another pattern is framed.

Yet, as a general rule, there is some irregularity ruling the stock cost, as vulnerability encompasses the stock value development due to the unstable idea of the market How to Select Stock for Short Term Trading?

Choosing the stock is a fundamental cycle under specialized examination; this methodology is basically utilized by merchants for momentary exchanging.

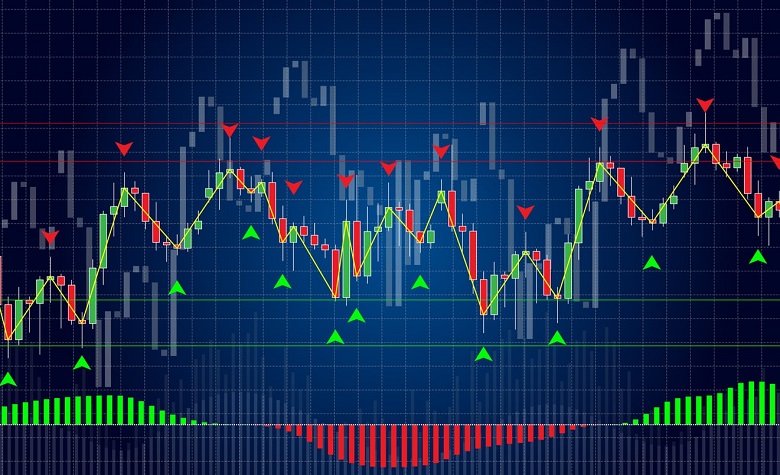

Stock Charts

Utilizing stock outlines is a fundamental part of specialized investigation, playing out a specialized examination without utilizing stock diagram resembles driving a bike without petroleum. The stock diagram is the graphical understanding of the stock value patterns. Stock outline portrays the exchanging volume concerning time. There are fundamentally three sorts of outlines utilized broadly.

-Line graph

-Point and Figure graph

-Candle outline

-In ensuing websites, we will profound jump into how to utilize these diagrams to waitlist the stocks.

-Straightforward Moving Averages Method

Straightforward Moving Averages takes a normal of 20 days, 50 days, 100 days, and 200 days and is utilized by the examiners to settle on purchasing and selling choices of the stock. It is mostly fit to anticipate whether the resource cost will keep on being same, or will it show a converse pattern.

Momentary moving midpoints rush to react to the adjustments in the stock cost, while long haul midpoints are delayed to respond to the equivalent.

The investigators inspect the course of the moving midpoints to get a thought regarding the stock value patterns. On the off chance that the cost is in reach, the point of moving midpoints will be sideways. In the event that the cost is falling, the pointer will be the descending way, and when the cost goes up, the bolt of moving midpoints shows an upward pattern in the stock cost.

Backing and Resistance Levels

The help cost is where there are a greater number of purchasers than merchants, and interestingly, the obstruction level is the place where dealers are similarly more than purchasers.

The obstruction level is the level above which the stock cost won't build as a result of high inventory.

The odds of the value rising, arriving at the obstruction level, from that point declining is high. The obstruction level demonstrates that now it is an ideal opportunity to sell the stock.

The help level is the value point on the diagram where the stock cost is kept from falling further. At the point when the value tumbles to the help line, the stock value skips back. Backing level gives a sign to purchase the stocks.

Specialized investigation utilizes backing and obstruction level to recognize value focuses on diagrams, where the stock cost can be anticipated, concerning whether it will continue as before or will show a converse pattern.

The Advantages of Technical Analysis

Information for anticipating the future stock cost is effectively accessible and solid in the event of specialized investigation. The specialized information joins the monetary pointers, thusly the investigators don't sit tight for the month to month or quarterly report to notice and afterward act.

Specialized examination gives fast data as all the information gets accessible in one outline. In a small amount of seconds, the financial specialist can perceive if the exchange merits entering.

The benefit target and danger the executives boundaries can be effectively evaluated.

The Disadvantages of Technical Analysis

Specialized examination doesn't take a profound drive in the expanse of the financial exchange and its patterns. A more profound arrangement gets guaranteed by crucial examination.

The specialized investigation shows the transient patterns in stock cost however neglects to give a drawn out examination of stock value patterns. The drawn out examination is expressed by essential investigation.

Finally, the specialized investigation is the adept apparatus at foreseeing future stock costs by utilizing past patterns for the transient exchanging request to bring in snappy cash.

For any insurance questions, call 011-41428141, 9910907557

Email Id – kapil@delifyinvestments.com

Read Also - Impact Of Coronavirus On Indian Financial Markets

Like our Facebook page - Delify Investments